Debt freedom made simple

Welcome to our blog!

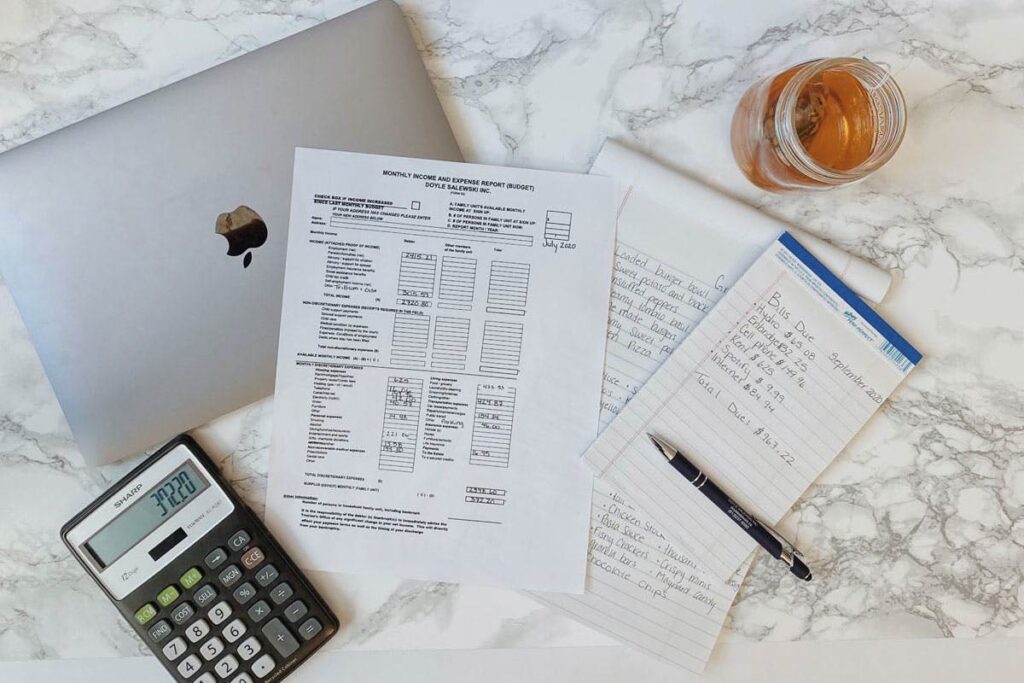

Financial recovery requires the right tools

DSI's Finance Blog: Valuable finance pro tips for Canadians

What a Credit Counselling Firm Can Do for You—and What it Can’t Do.

/*! elementor – v3.10.2 – 29-01-2023 */ .elementor-heading-title{padding:0;margin:0;line-height:1}.elementor-widget-heading .elementor-heading-title[class*=elementor-size-]>a{color:inherit;font-size:inherit;line-height:inherit}.elementor-widget-heading .elementor-heading-title.elementor-size-small{font-size:15px}.elementor-widget-heading .elementor-heading-title.elementor-size-medium{font-size:19px}.elementor-widget-heading .elementor-heading-title.elementor-size-large{font-size:29px}.elementor-widget-heading .elementor-heading-title.elementor-size-xl{font-size:39px}.elementor-widget-heading .elementor-heading-title.elementor-size-xxl{font-size:59px} Home / Blog / Credit Aside from offering help with money management (setting up a budget) and debt counselling (a discussion of your financial options), the main service offered by most credit counselling firms is a

5 Steps to Rebuilding Your Credit Rating

Home / Blog / Credit There’s no doubt about it. Filing a consumer proposal or bankruptcy will affect your credit rating—and not necessarily in a good way. Both events will be noted on your credit report: a first bankruptcy will remain on your file for about seven years (assuming you’re

What if you own your own business

Home / Blog / Financial If you own an incorporated business, you may be wondering what will happen to it if you file a consumer proposal. Will you have to sell it or turn it over to your proposal trustee? In most cases, probably not. As long as your financial difficulties

What Happens If I Default on My Consumer Proposal

Home / Blog / Consumer Proposal Once you’ve filed a consumer proposal and it has been accepted by your creditors, it is legally binding on both you and them. You must make the payments you’ve agreed to, and your creditors cannot take any further action against you as long as

My Creditors Refused My Consumer Proposal: Now What?

Home / Blog / Consumer Proposal Generally speaking, creditors will accept a consumer proposal that is reasonable. They’ll have done their calculations (just as your trustee did) and determined that they stand to gain more from a proposal than they might if you become bankrupt. Occasionally, however, the majority of your

Home Ownership During a Consumer Proposal

Home / Blog / Consumer Proposal You’ve come to terms with the fact that you’re insolvent, done your research, and you think you’re ready to talk to a trustee about making a consumer proposal. But wait…what happens to your house if you do? Will you lose it? Will the bank