Debt freedom made simple

Welcome to our blog!

Financial recovery requires the right tools

DSI's Finance Blog: Valuable finance pro tips for Canadians

Talking Finances with Family

Home / Blog / Financial / Savings & Retirement by Katie Weber Money and stress go hand in hand and there are countless statistics to prove it. So why is talking about money with family and loved ones such a taboo topic? Today (and every day) we are going to

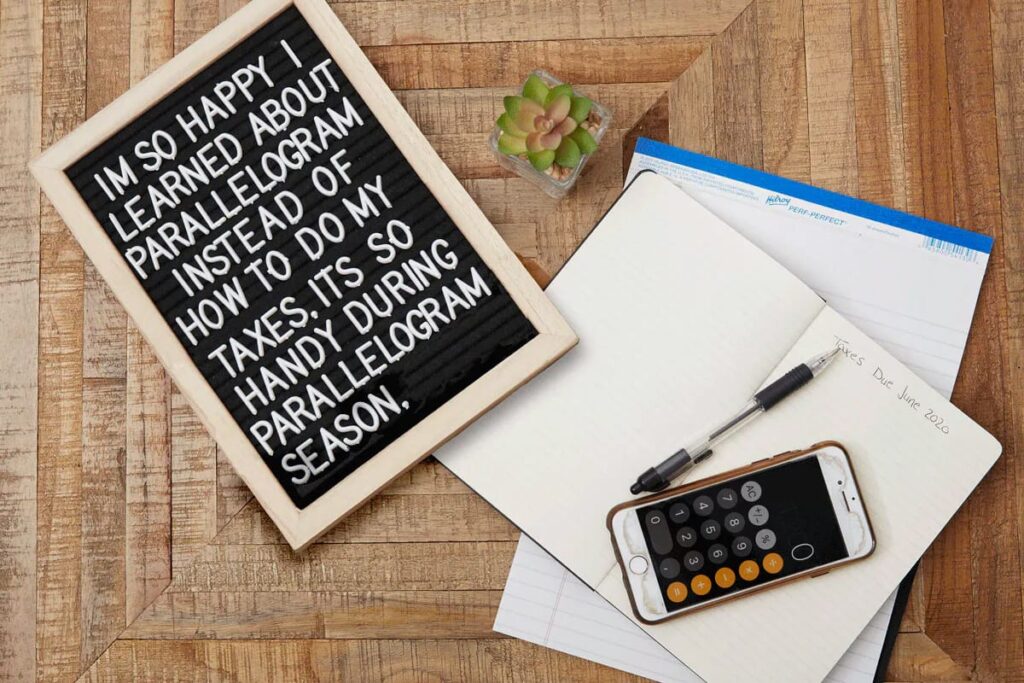

The tax deadline is quickly approaching

Home / Blog / Taxes The tax deadline is quickly approaching, which if you didn’t know, is June 1st, (how are we almost in June?!) which is why we decided to put together our best tax tips for getting them done with ease along with free software to make the

COVID-19 in Canada How to Manage Your Finances in Uncertain Times

Home / Blog / Covid-19 / Financial by Janet Doyle Many Canadians are facing uncertainty as the effects of the COVID-19 pandemic changes our ability to work, pay our bills, keep a roof over our heads and put food on the table. As businesses are forced to shut their doors,

Plan a Wedding on a Budget: 7 things to Consider, plus 18 ways to save!

Home / Blog / Financial, Savings by Janet Doyle According to TheKnot.com, the average couple spends $29,450 on their wedding. Even attending a wedding typically costs $888 while members of the wedding party can expect to pay well over $1000 to be a part of the big day. Given the

How to Deal with the Christmas Spending Hangover

Home / Blog / Financial, Savingsby Janet Doyle If you’re like most Canadians, Christmas is a time for spending. In addition to gifts, there’s travel, holiday parties, Christmas baking, and other expenses that seem to creep up seemingly out of nowhere. Most people don’t have a budget for the holidays,

12 Ways to Save on Back to School Shopping

Home / Blog / Savings by Janet Doyle It may come as a shock that Canadian families spend more on back to school than Christmas. An Angus Reid poll of more than 1,400 Canadians shows that 76% of moms say that back to school shopping puts a strain on finances,