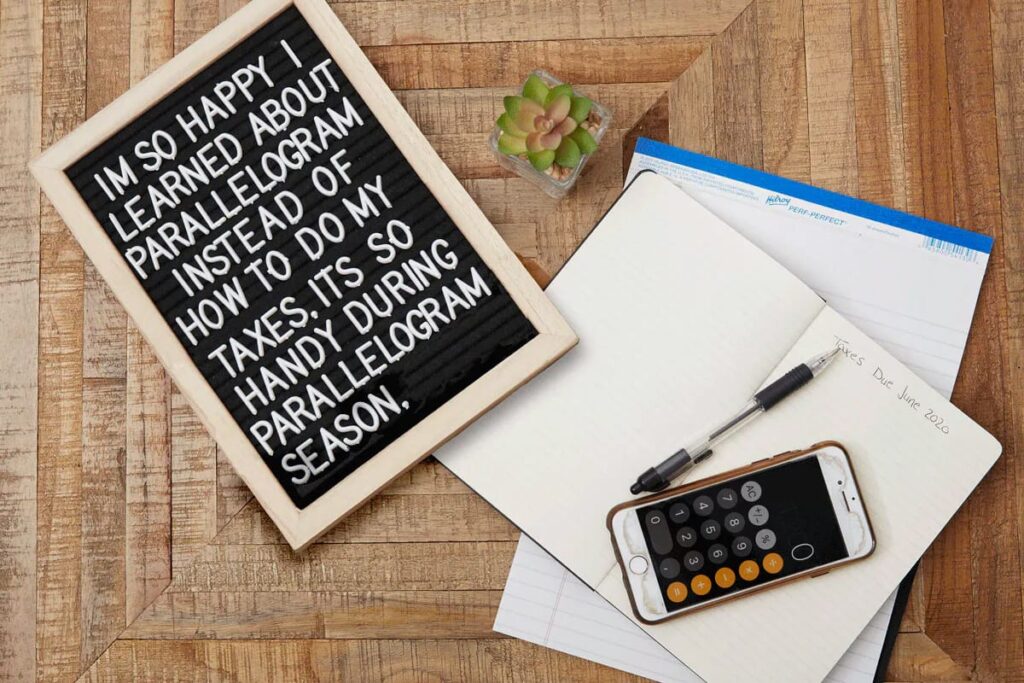

The tax deadline is quickly approaching

Home / Blog / Taxes The tax deadline is quickly approaching, which if you didn’t know, is June 1st, (how are we almost in June?!) which is why we decided to put together our best tax tips for getting them done with ease along with free software to make the job that much easier. 1. Know […]

COVID-19 in Canada How to Manage Your Finances in Uncertain Times

Home / Blog / Covid-19 / Financial by Janet Doyle Many Canadians are facing uncertainty as the effects of the COVID-19 pandemic changes our ability to work, pay our bills, keep a roof over our heads and put food on the table. As businesses are forced to shut their doors, many employees are being laid […]

Plan a Wedding on a Budget: 7 things to Consider, plus 18 ways to save!

Home / Blog / Financial, Savings by Janet Doyle According to TheKnot.com, the average couple spends $29,450 on their wedding. Even attending a wedding typically costs $888 while members of the wedding party can expect to pay well over $1000 to be a part of the big day. Given the high cost of the celebrations, […]

How to Deal with the Christmas Spending Hangover

Home / Blog / Financial, Savingsby Janet Doyle If you’re like most Canadians, Christmas is a time for spending. In addition to gifts, there’s travel, holiday parties, Christmas baking, and other expenses that seem to creep up seemingly out of nowhere. Most people don’t have a budget for the holidays, and for those that do […]

12 Ways to Save on Back to School Shopping

Home / Blog / Savings by Janet Doyle It may come as a shock that Canadian families spend more on back to school than Christmas. An Angus Reid poll of more than 1,400 Canadians shows that 76% of moms say that back to school shopping puts a strain on finances, and 40% say it will […]

How to Deal with Tax Debt

Home / Blog / Debtby Janet Doyle If you’re feeling overwhelmed by outstanding tax debts, you aren’t alone. In 2018, Canadians owed $43.8 billion in outstanding tax debt to the Canada Revenue Agency. The CRA has been working hard to collect the debt from Canadians, and the CRA’S ability to seize bank accounts, garnish wages, […]

5 Reasons Why You are In Debt

Home / Blog / Debtby Janet Doyle It is July 31, 2019 and today the United States Federal Reserve dropped the US interest rate by .25%. To quote financial guru Gerald Celente: “Across the globe, central banks are pushing interest rates lower and governments are going deeper in debt as they shovel in more artificial […]

Tips on Pension Garnishment for Seniors in Debt

Home / Blog / Debtby Janet Doyle If you’re a senior in debt, you’re not alone. According to a survey, the average Canadian senior carried $29,973 in debt and 30% of Canadians aged 55-70 were still working because they needed to. The Financial Planning Standards Council Foundation found that while 56% of Canadians had debt; […]

What You Need To Know About Home Equity Lines of Credit (HELOC)

Home / Blog / Creditby Janet Doyle A home equity line of credit (HELOC) has become a popular way for Canadian consumers to access additional credit at a low interest rate; but with fluctuating real estate markets they can be a riskier option than people realize. Flexible repayment plans and high credit limits make home […]

Quebec Residents Hit With Credit Card Minimum Payment Hike

Home / Blog / Credit by Janet Doyle Mandatory Minimum Credit Card Payments in Quebec Are Going Up! Could this also happen in other provinces? Here’s what you need to know: On August 1, 2019, Quebec residents will be required to pay at least 2% of the balance owing on their credit cards. Minimum payments […]