Home / Blog / Debt, Financial Health, Savings & Retirement

by Katie Weber

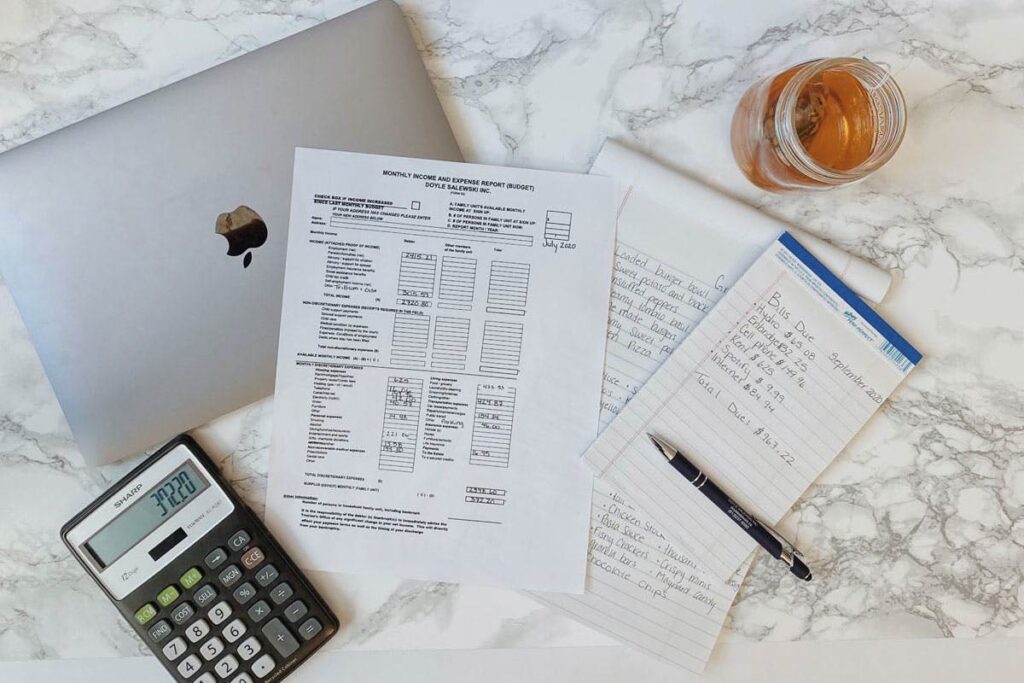

Let’s talk about budgeting, more so how to budget during a recession. I know what you’re thinking: budgeting and recession are two dirty words we don’t want to think about, but now more than ever we need to face them. Everyone should be budgeting no matter how much money you make or how financially well off you are. Budgeting brings more financial structure and less stress.

Having a budget will help you reach your financial goals and bring more security for unexpected financial hardships (i.e Covid-19). Here are 4 key tips to help you prepare your finances for a recession and come back better than ever:

1. Start or build up your emergency fund.

Recessions bring along a lot of uncertainty about everything: income, the housing market, trades etc. The easiest way to start preparing for anything is to build up or start your emergency fund. Having an emergency fund can save you a lot of stress and help you avoid becoming financially over-extended.

To start, you want to put aside 3-6 months of basic living expenses in an emergency account. This will create a financial buffer that can keep you afloat in a time of need without having to rely on credit cards or take out high-interest loans.

2. Pay off your debts.

I know that paying off your debt is easier said than done but the last thing anyone needs is the additional stress that debt brings. Whether you cut expenses elsewhere in your budget to pay down your debt , removing debt will reduce stress in the long run and provide additional income when the debts are gone.

3. Learn how to live within your means.

Living within your means is essentially widening the gap between your income and your expenses. To do this, you need to focus on your needs and cut down on your wants, reduce your expenses (I’m talking about uber eats, amped up phone and cable plans, and impulse online shopping trips) and track your expenses. But while doing all of this, don’t deprive yourself; living within your means is all about making smart choices.

4. Make new streams of money.

This is the most fun tip out of the bunch because this is taking a hobby/craft you enjoy and turning it into a side business. Everyone is crafty in their own way, so why not make something out of it? Tons of people are selling tie dye products, homemade jewelry, and even baked goods (Is that where all the flour is disappearing to?) Why not have fun and make a little extra money?

While we can’t predict a recession or a global pandemic, what we can do is be prepared and these tips are a great place to start.