Debt freedom made simple

Bankruptcy filing Services in Ottawa, Ontario

A Bankruptcy provides you with a fresh start by eliminating your debts

When you need a fresh start

Personal Bankruptcy

Bankruptcy is a legal process designed to help individuals get a fresh financial start when debt becomes unmanageable. It provides immediate protection from creditors and can eliminate most, if not all, of your unsecured debts. Across Canada, from Ontario to Quebec and beyond, thousands of people turn to bankruptcy each year to regain control of their financial lives.

Filing for bankruptcy can significantly reduce your debt and stop collection actions, giving you the chance to rebuild your financial future. It’s a structured process that offers relief, and we’ll guide you every step of the way to ensure you’re on the right path.

If you’re feeling overwhelmed by debt, bankruptcy could be the best way to secure your financial future. Thousands of Canadians use this option to wipe the slate clean and begin their journey toward financial stability.

Scroll down to find the essential information Ontario residents and Canadians everywhere should know when considering bankruptcy as a debt relief solution.

Clear path to recovery

Immediate debt relief

Structured legal process

Protection from creditors

FAQ

Common questions about Bankruptcy

What will a Licensed Insolvency Trustee do for me?

Do I need a lawyer?

Who will know I’ve filed for bankruptcy? Will a notice be published in the newspaper?

Can a bank refuse to open an account for me because I’m bankrupt?

No. In fact, a Canadian bank cannot refuse to open a personal bank account for any of the following reasons:

- bankruptcy

- joblessness

- lack of deposit funds at the time of opening the account

Where can I get more information about personal bankruptcy?

Declaring bankruptcy Ottawa can be the fastest, easiest, and most affordable way to relieve yourself of overwhelming debt. From Vancouver to Ottawa to St. John’s, thousands of financially insolvent Canadians file for bankruptcy every year, taking the first step in their journey toward a brighter financial future.

Scroll down for info on bankruptcy Ontario residents and Canadians should know when considering bankruptcy as a debt solution.

What is bankruptcy?

Put simply, bankruptcy is a legal process that lets you clear your debts – and Canadians have a lot of debt. In 2020, Statistics Canada reported that the average Canadian household was holding $1.77 of credit market debt for every dollar of disposable income.

That’s why good faith debtors (i.e.; an insolvent person) have the right to make a fresh financial start by declaring bankruptcy. The Canadian Bankruptcy and Insolvency Act (BIA) is federal legislation designed to help protect individuals from inescapable debt, and it gives insolvent debtors certain tools for resolving their debt with creditors.

In other words, if you find yourself with debt you can’t afford to pay back, you have options.

Understanding what those options are begins with finding a Licensed Insolvency Trustee.

What is a Licensed Insolvency Trustee

A Licensed Insolvency Trustee (LIT) acts as a bankruptcy advisor and administrator. They’re responsible for helping you understand your financial situation and will provide you with debt reduction strategies based on what you earn, own, and owe.

Ottawa residents, for example, can get help with bankruptcy in Ontario by contacting an LIT like Doyle Salewski. Our firm has guided more than 20,000 clients in Ontario and Quebec through insolvency and toward financial freedom.

Read our helpful bankruptcy Frequently Asked Questions guide to answer some of the common bankruptcy questions our clients have asked us over the 25 years we’ve been providing debt relief solutions in Ottawa and beyond.

Why do I need a Licensed Insolvency Trustee?

LITs are the government-authorized administrators of insolvency proceedings. LITs are regulated by the Office of the Superintendent of Bankruptcy Canada (OSB) and are the only professionals who can file a bankruptcy or consumer proposal application in your name.

Do I need a lawyer to file bankruptcy?

You don’t need to hire a lawyer to file for bankruptcy. If your circumstances are particularly complex or you would like to involve a lawyer in your filing, your trustee will work with your choice of counsel. Most bankruptcy filings, however, do not require a lawyer.

What are the advantages of filing bankruptcy?

When your chosen trustee files a bankruptcy application in your name with the OSB, the trustee is now responsible for your debt-related legal obligations. This means:

- You can stop making payments to your creditors

- Any and all legal action against you by creditors will stop

- Creditors will not be able to garnish your wages

For many, having a licensed professional act on their behalf when dealing with creditors is the first wave of relief that comes with beginning a debt solution.

It’s also understood that personal financial hardship is just that — personal. That’s why individual bankruptcy filings are only ever discussed between you, your trustee, your lawyer (if you use one), your creditors and their agencies.

And while some worry that bankruptcy will permanently ruin their credit score, the truth is that filing for insolvency will only have a temporary impact on your credit. A bankruptcy filing can be removed from credit reports in as little as six years.

Can you file for bankruptcy in Ottawa more than once?

You can file for bankruptcy multiple times – and repeat bankruptcy is more common than you might think. In 2019, more than 20% of those who filed for insolvency with the OSB had a previous bankruptcy.

Your responsibilities and the length of your bankruptcy will depend on whether this is your first bankruptcy filing or a repeat filing (see our FAQ about bankruptcy for more details).

What are the requirements of filing bankruptcy?

Who can file for bankruptcy?

The criteria for being able to file bankruptcy is simple:

- You must owe at least $1,000;

- You can’t make your payments as they come due; and,

- You don’t have sufficient assets to pay off your debt.

What kind of debt can I discharge with bankruptcy?

Bankruptcy relieves most kinds of unsecured debt, whether that’s credit card debt, payday loans, tax debt, bank loans, or a line of credit.

Debts that are not dischargeable by bankruptcy include:

- Court imposed fines, penalties, and restitution orders

- Speeding tickets and parking tickets

- Child support, spousal support, or alimony

- Debts created by fraud (including embezzlement, misappropriation or fraudulent misrepresentation)

- Civil court damages awarded against you

- Student loans for studies within the last 7 years

Can I file for bankruptcy if I live abroad?

If you’re a Canadian citizen living internationally but have debts in Canada, the simplest way to file for bankruptcy is to return to Canada and give a trustee your bankruptcy paperwork.

If you prefer to stay outside of Canada, you can file for bankruptcy if:

- You’ve carried on business in Canada within the year preceding bankruptcy;

- You have resided for the previous 12 months in Canada; or

- The majority of your property is located in Canada (this includes money held in a Canadian bank, real estate, and some possessions).

What do I need to do to file for bankruptcy?

The first step to filing for bankruptcy is to find a Licensed Insolvency Trustee who will act as your trustee and file your bankruptcy application. You cannot file bankruptcy yourself.

The requirements for debtors filing bankruptcy can sometimes differ depending on which province you file for bankruptcy in. Whether you declare bankruptcy in Ontario, Quebec, or any other province, trustee will need you to be open about your debts and assets.

If your trustee asks for your help with processing your filing, then you must assist them. For example, bankruptcy trustee in Ontario require you to:

- Attend 2 financial counselling sessions to discuss your situation and options

- Provide all information related to your tax returns for the year of your bankruptcy, as well as for previous years

- Disclose your income and expenses for every month you are in bankruptcy

- Surrender your credit cards

- Pay surplus income payments into your bankruptcy estate

- Be available for an examination by OSB, if requested, or by one of your creditors, if they are granted an examination

- Be available to attend a meeting of your creditors, if requested

- Assist them in the sale of your non-bankruptcy exempt assets

- Inform them of any property you acquire during the bankruptcy period, including inheritances, sizable gifts, income tax refunds, and lottery winnings.

*Tip* Read our FAQ for more detailed information on subjects like surplus income payments and exempt assets.

How much does it cost to retain a bankruptcy trustee?

Filing for bankruptcy comes with associated costs set by the federal government and the trustee. The cost of retaining an LIT for your bankruptcy file will be about the same across Canada, whether you declare bankruptcy in Ottawa or Moosejaw.

Generally, a debtor with no surplus income can expect to pay approximately $200 per month to a trustee during their bankruptcy period. This amount covers:

- A fee for filing the necessary paperwork with the OSB

- Your two mandatory counselling sessions

- Administration of the file

- Fees for a Bankruptcy Court hearing (if one is necessary)

Finding an LIT who understands your situation is important when filing for bankruptcy. That’s why Doyle Salewski offers a free consultation for all Ontario and Quebec residents interested in declaring bankruptcy to eliminate their debt.

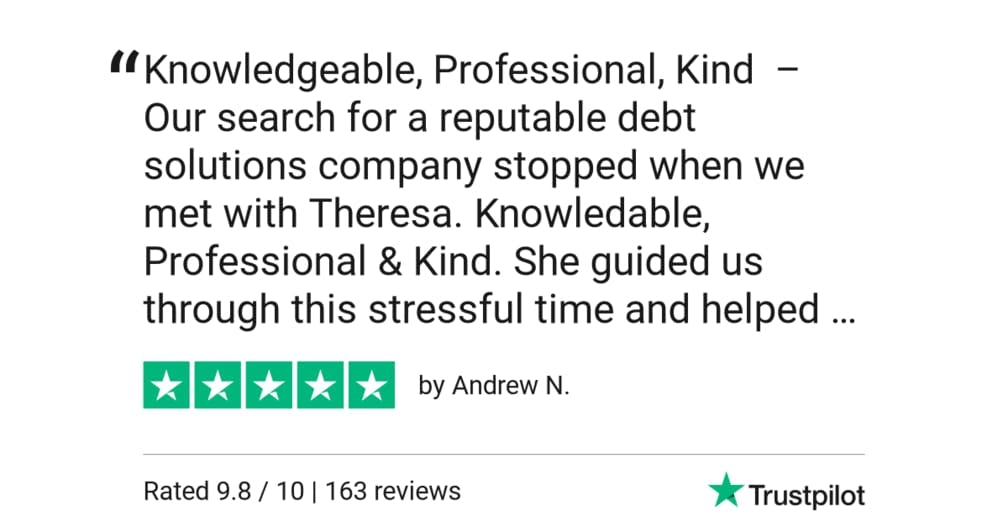

Our satisfied client base has made us one of the highest-rated LITs in Ontario, and our Ottawa, ON offices are available for contact at 613-237-5555.

Bankruptcy or Consumer Proposal: Which is right for you?

Another question many Canadians ask before they declare bankruptcy is whether a consumer proposal is the best option for reducing their debt.

As with bankruptcy, a consumer proposal gives good faith debtors a way of solving their debt problems and hitting the reset button on their financial situation. In fact, 60% of the insolvency filings made to the OSB in 2019 were proposals.

Your trustee will advise you on whether filing a consumer proposal or bankruptcy is best for your situation, and you can read more about the difference between the two on our guide to Bankruptcy vs. Consumer Proposal.

For bankruptcy advice in Ottawa, Ontario call us at (613) 237-5555.