Can Creditors Garnish CPP or OAS? How a Consumer Proposal Protects You

Worried about debt in retirement? Learn if creditors like the CRA can garnish your CPP or OAS. A consumer proposal can stop collections & protect your pension income.

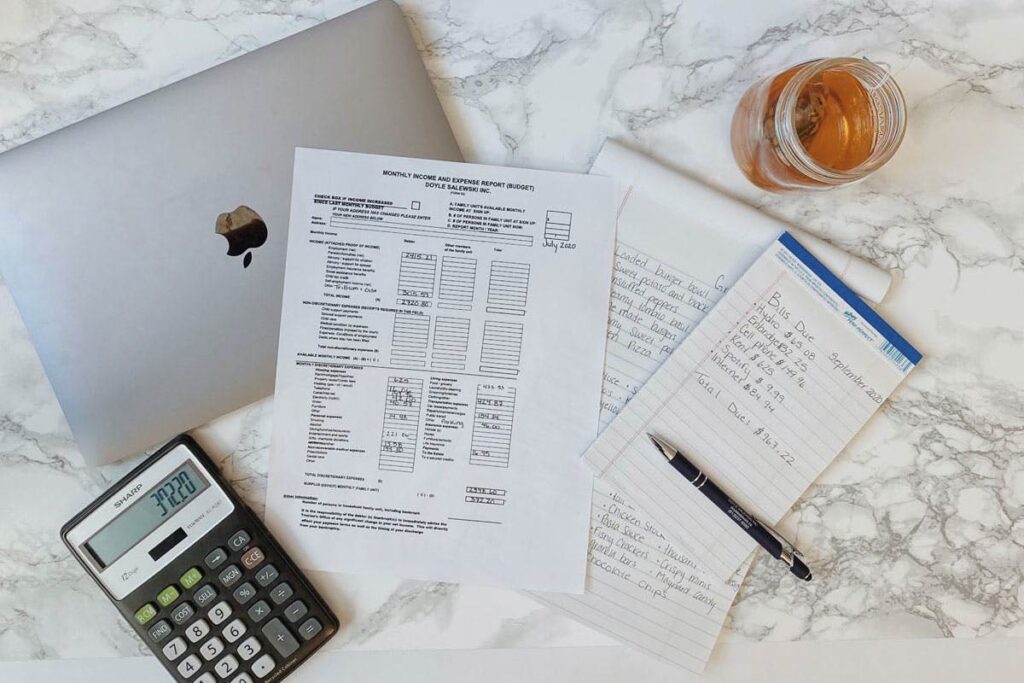

Financial recovery requires the right tools

Worried about debt in retirement? Learn if creditors like the CRA can garnish your CPP or OAS. A consumer proposal can stop collections & protect your pension income.

Home / Blog / Debt, Financial by Katie Weber It’s beginning to cost a lot like Christmas! While it is lovely to give and receive gifts, it can put a strain on anyone’s budget, especially this year. At the same time, it’s getting late to save for Christmas. You can

Let’s talk about budgeting, more so how to budget during a recession. I know what you’re thinking: budgeting and recession are two dirty words we don’t want to think about, but now more than ever we need to face them.

The fear of missing out (FOMO) is massive now. A new Credit Karma survey of 1,050 Canadians aged 19-39 shows half of young adults have spent money they didn’t have and gone into debt in order to keep up with their peers.

Home / Blog / Financial / Savings & Retirement by Katie Weber Money and stress go hand in hand and there are countless statistics to prove it. So why is talking about money with family and loved ones such a taboo topic? Today (and every day) we are going to

Home / Blog / Financial, Savingsby Janet Doyle If you’re like most Canadians, Christmas is a time for spending. In addition to gifts, there’s travel, holiday parties, Christmas baking, and other expenses that seem to creep up seemingly out of nowhere. Most people don’t have a budget for the holidays,

Home / Blog / Debtby Janet Doyle If you’re feeling overwhelmed by outstanding tax debts, you aren’t alone. In 2018, Canadians owed $43.8 billion in outstanding tax debt to the Canada Revenue Agency. The CRA has been working hard to collect the debt from Canadians, and the CRA’S ability to

Home / Blog / Debtby Janet Doyle It is July 31, 2019 and today the United States Federal Reserve dropped the US interest rate by .25%. To quote financial guru Gerald Celente: “Across the globe, central banks are pushing interest rates lower and governments are going deeper in debt as

Home / Blog / Debtby Janet Doyle If you’re a senior in debt, you’re not alone. According to a survey, the average Canadian senior carried $29,973 in debt and 30% of Canadians aged 55-70 were still working because they needed to. The Financial Planning Standards Council Foundation found that while

Home / Blog / Creditby Janet Doyle As an organization dedicated to helping people, we often refer clients to a solution that may be outside of the services of Doyle Salewski. For a number of years, we’ve worked with not-for-profit credit counsellors and/or registered charities in partnership as part of